The professional risk managers' guide to the energy market

- ISBN: 9780071546515

- Editorial: McGraw-Hill Publishing Co.

- Fecha de la edición: 2008

- Lugar de la edición: New York. Estados Unidos de Norteamérica

- Colección: PRMIA risk management series

- Encuadernación: Cartoné

- Medidas: 24 cm

- Nº Pág.: 447

- Idiomas: Inglés

Manage financial and investment risk on a global scale with the very best in the field. Announcing the Partnership of McGraw- Hill and The Professional Risk Manager's International Association, made up of the world's leading risk management scholars and practitioners, The Professional Risk Manager's International Association (PRMIA) is the higher standard for risk professionals in the development of new techniques and best practices for effectively managing financial and investment risk. McGraw-Hill and PRMIA have joined together to bring you the most up-to-date, global reference materials on risk management available anywhere. Each title applies risk management to specific fields in the industry, allowing you to stay on the cutting edge of your profession, and maximize opportunities as they come.This title provides expert analysis on the energy market from veteran analysts and global professionals. "The Professional Risk Managers' Guide to the Energy Market" is a comprehensive reference for financial professionals affected by energy prices. Twenty experts from around the world discuss every aspect of energy trading and the risks associated with specific investment vehicles and energy sectors.Beginning with a comprehensive overview of energy futures, energy derivatives, and power markets around the world and their price drivers, the book goes on to explore specific energy risk management tools including coverage of the use of technical analysis in energy markets, creation and transfer of price risk in European energy markets, and the use of energy options to hedge risk. The reference closes with chapters on the importance of risk management software, deal capture, stress testing, and mark to market; energy hedging in Asian markets; trading electricity options; and weather risk management strategies.

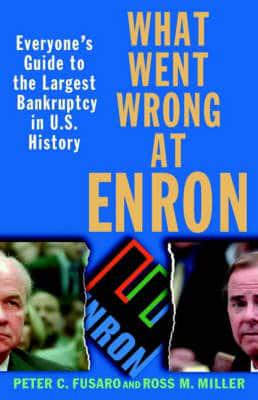

Ed. Peter Fusaro